Abu Dhabi First Bank

Digital Banking Platforms

MY ROLE

Product Design, UX and UI,

AREAS COVERED

FinTech, New Business Client Onboarding, Customer Support and Navigation, E-Signature, Identity Verification

Overview

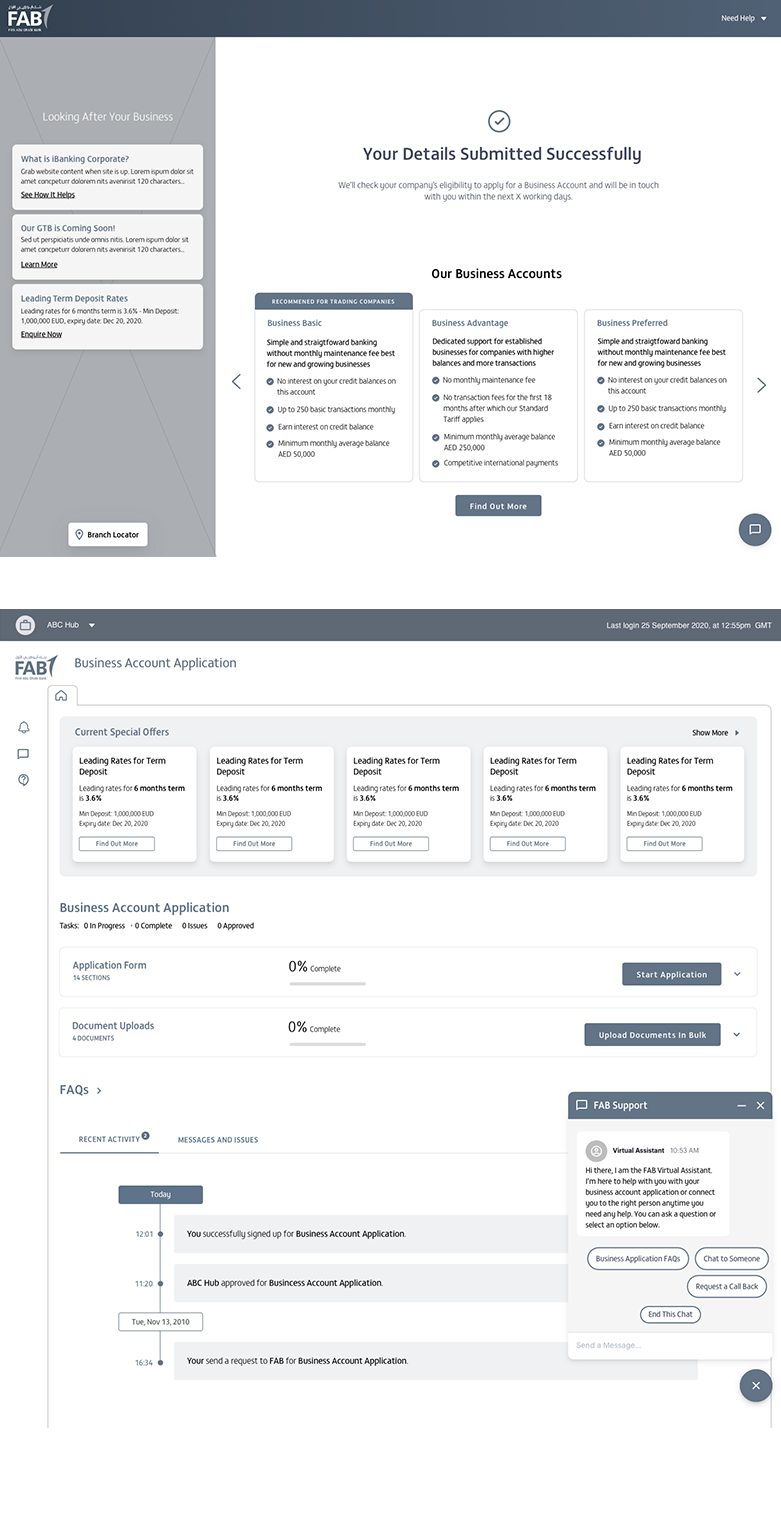

At Genieology agency, our team was entrusted with designing a modern, user-friendly daily banking application to empower business customers. The project aimed to integrate services from the bank's nine separate systems into a cohesive digital platform, addressing inefficiencies and improving the overall user experience.

My primary responsibility was to focus on the critical task of streamlining and digitising the onboarding processes for new business and corporate clients. This initiative was a top priority for the bank, targeting reduced operational costs and eliminating pain points caused by the existing fragmented, time-consuming and inefficient processes.

Case Study: Leading Digital Onboarding Design

My responsibilities and design process

-

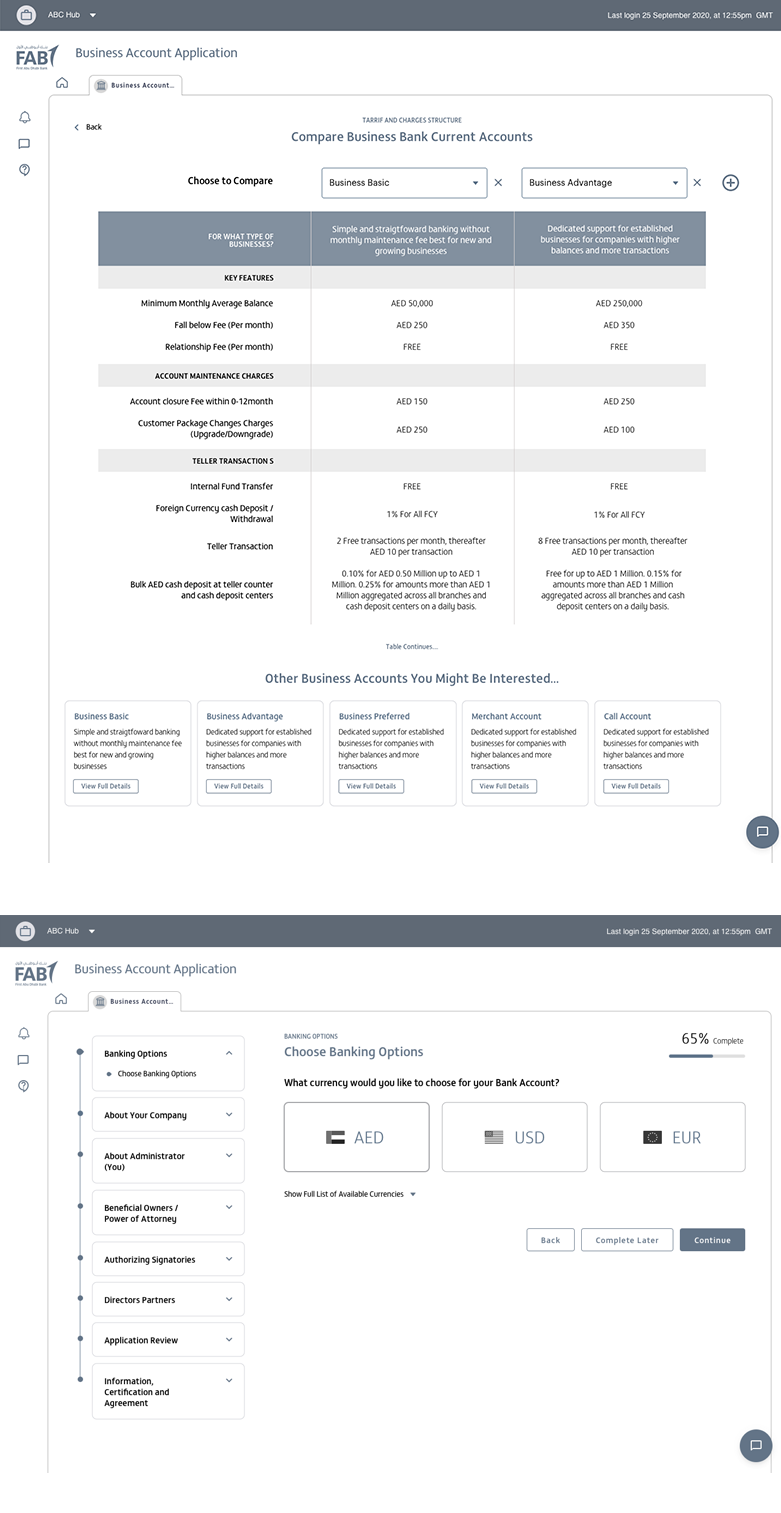

Competitor Research and Concept Exploration: Conducted in-depth analysis of competitor solutions to identify opportunities for innovation and improvement.

-

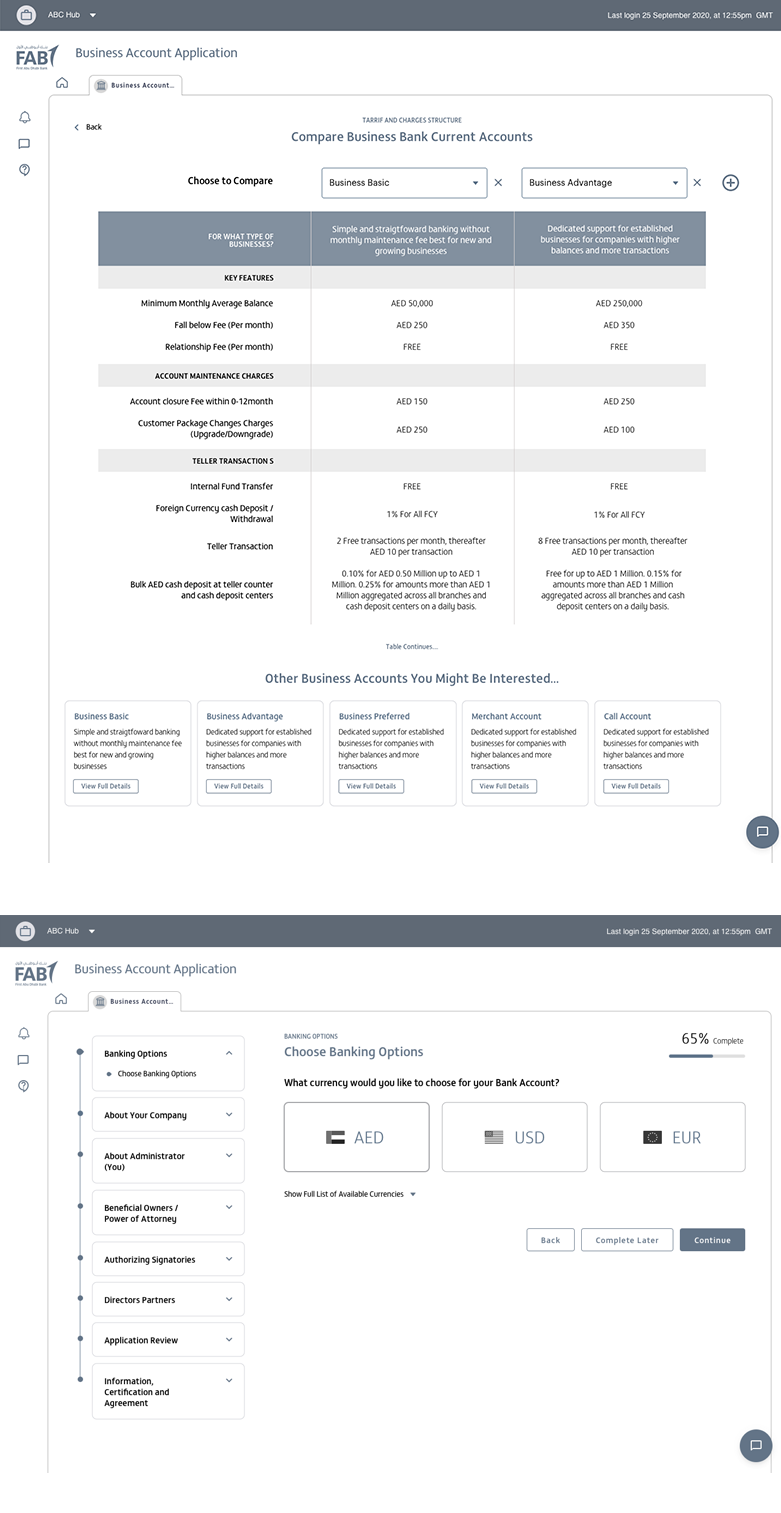

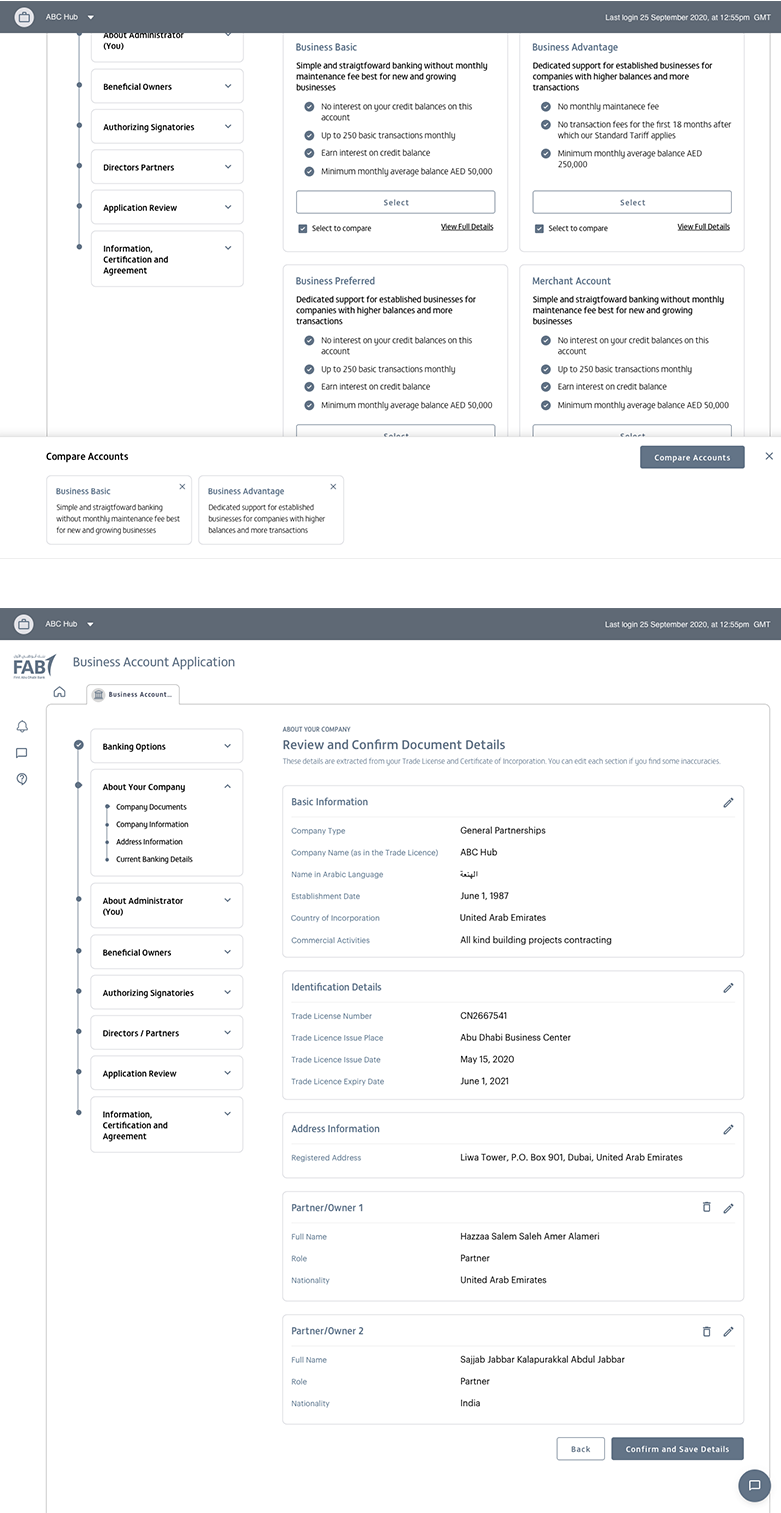

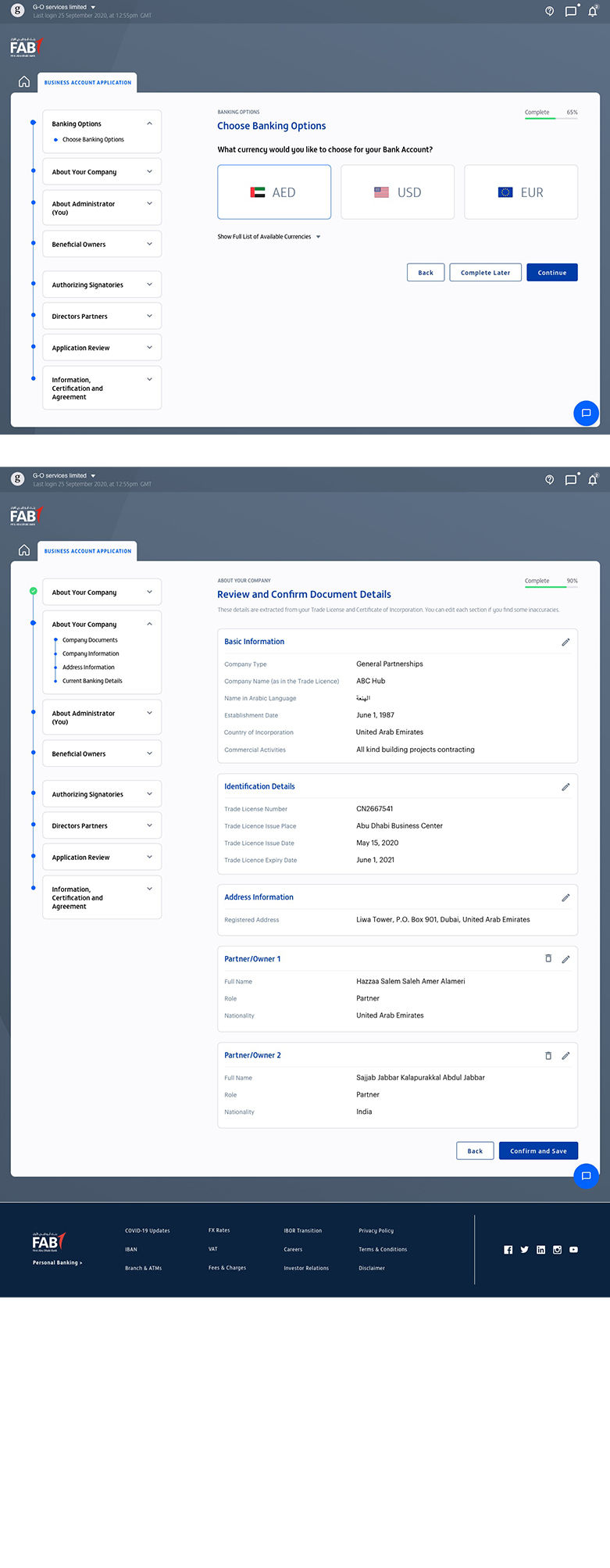

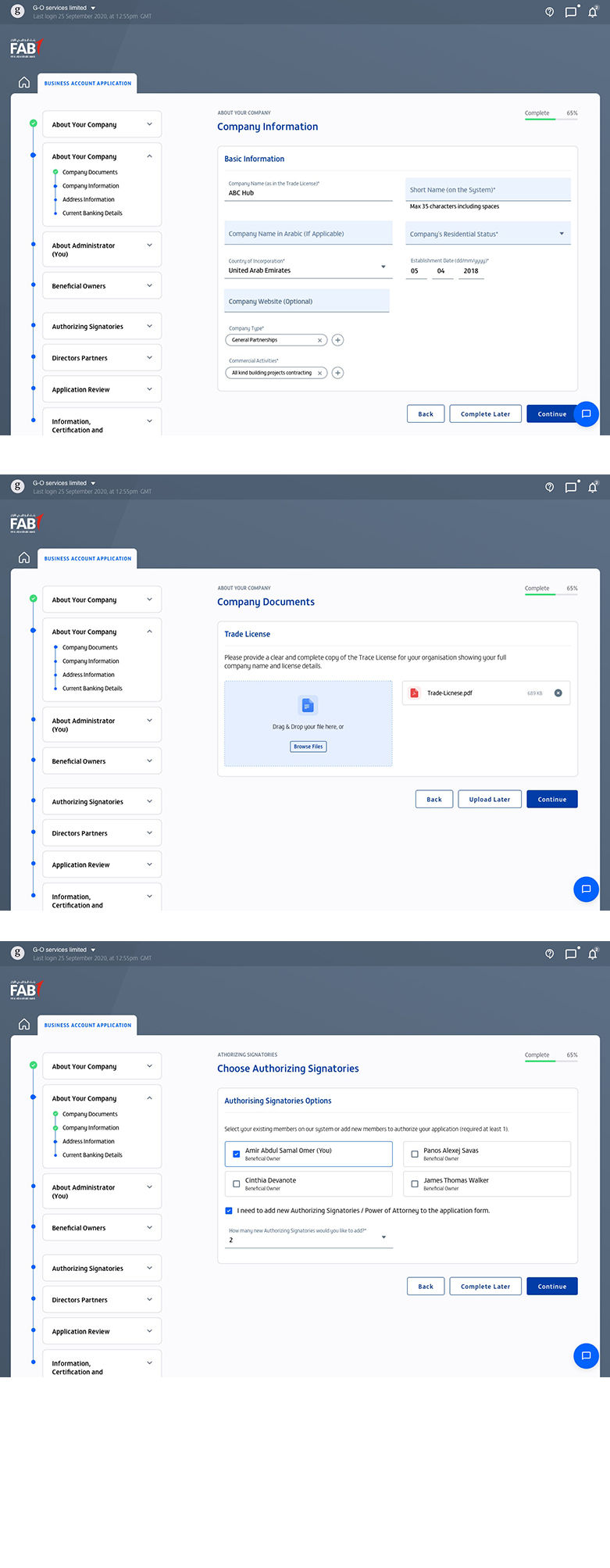

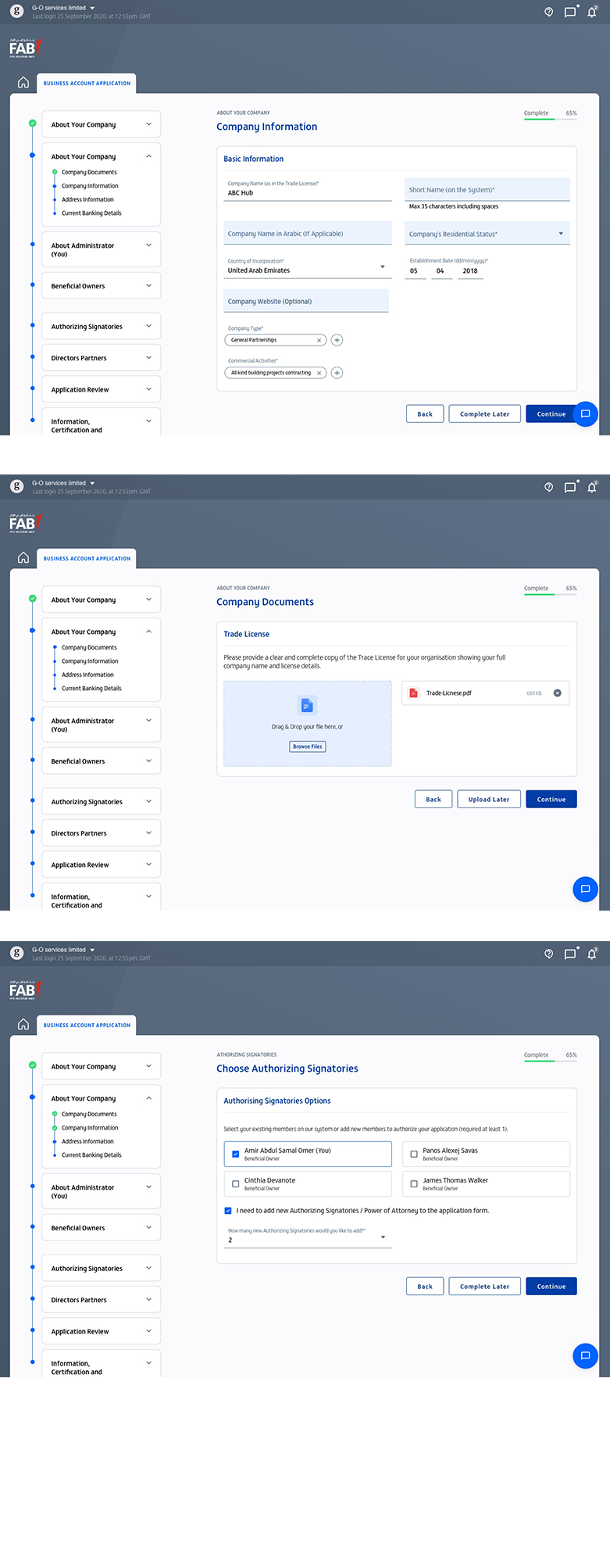

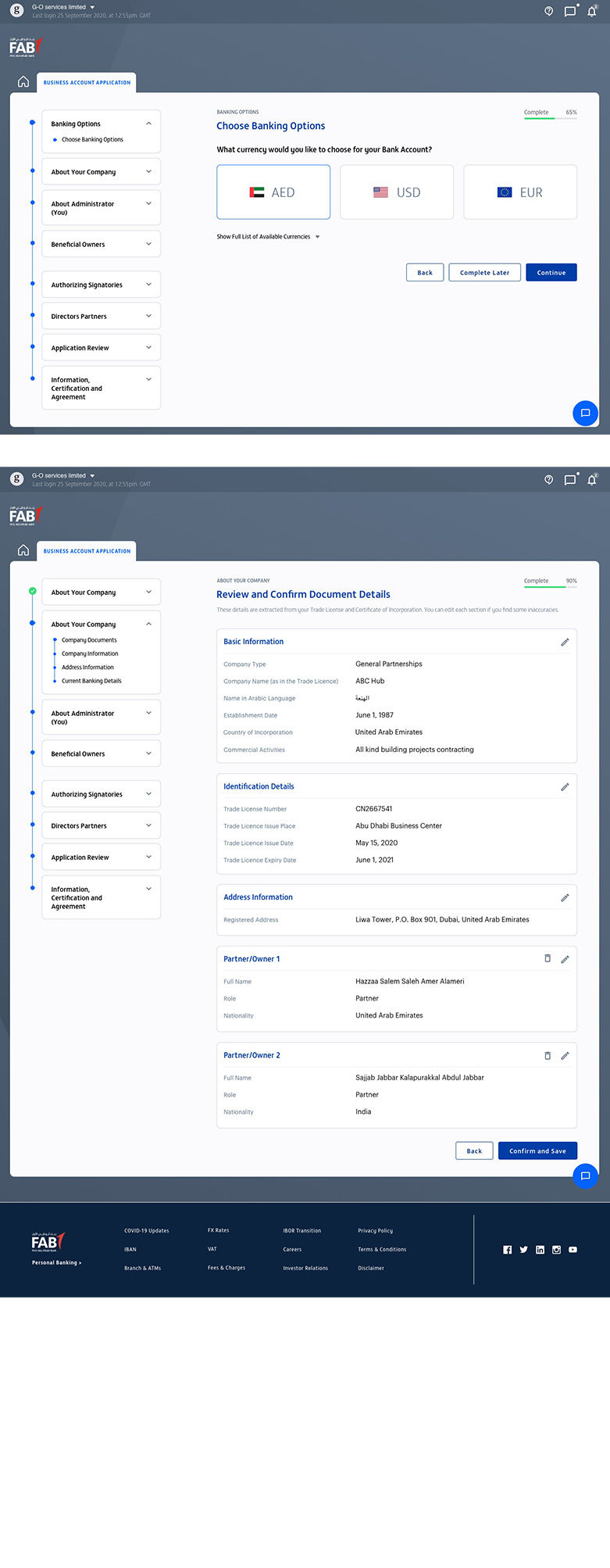

User Flows and Intuitive Design: Developed detailed user flows and crafted designs addressing pain points identified through workshops and using design thinking principles.

-

Identity Verification and Document Automation:

-

Explored and implemented advanced technologies for identity verification, document scanning and uploading, from pre-population.

-

Integrated third-party tools to retrieve company director and shareholder details, enabling pre-population of forms and reducing manual input.

-

-

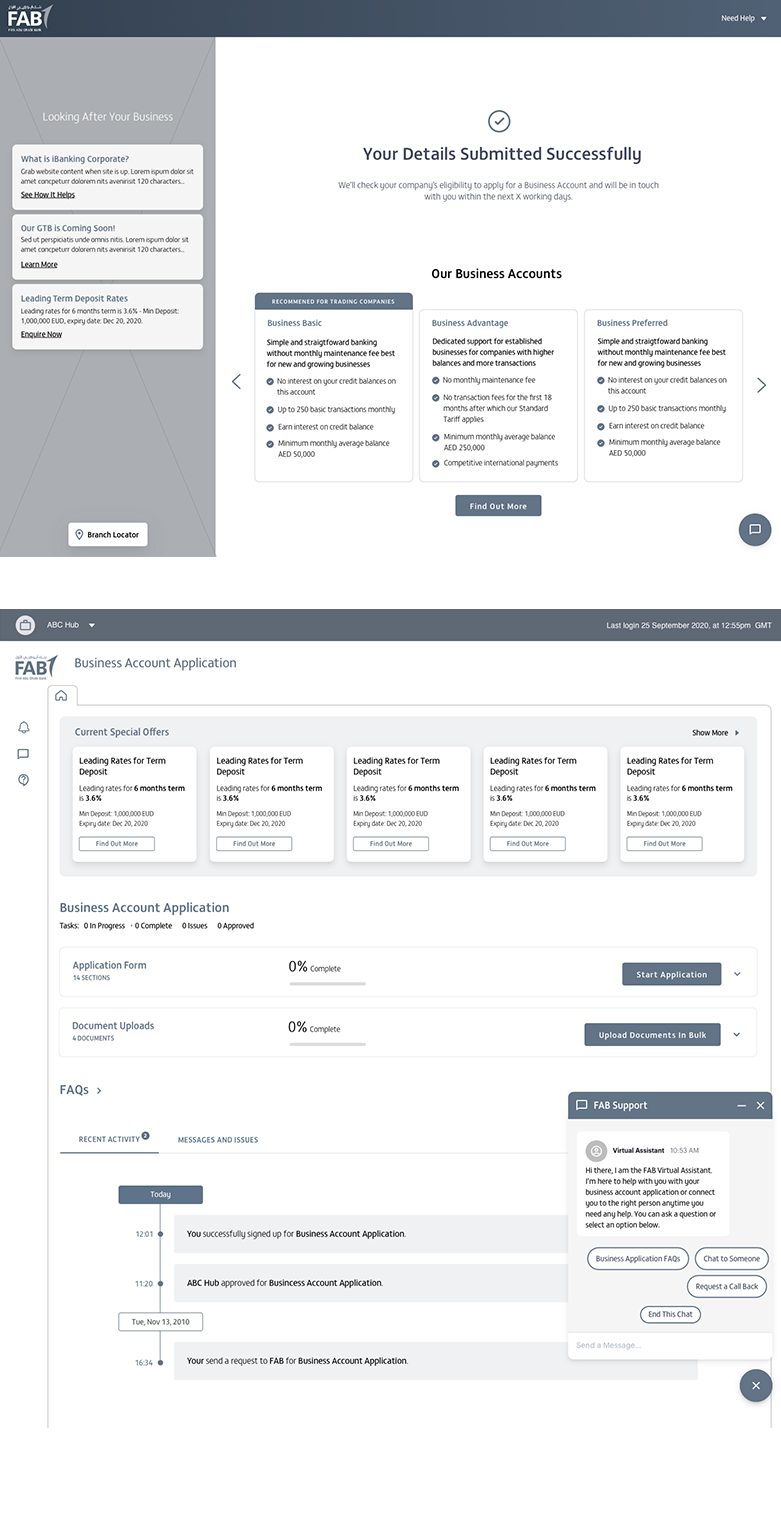

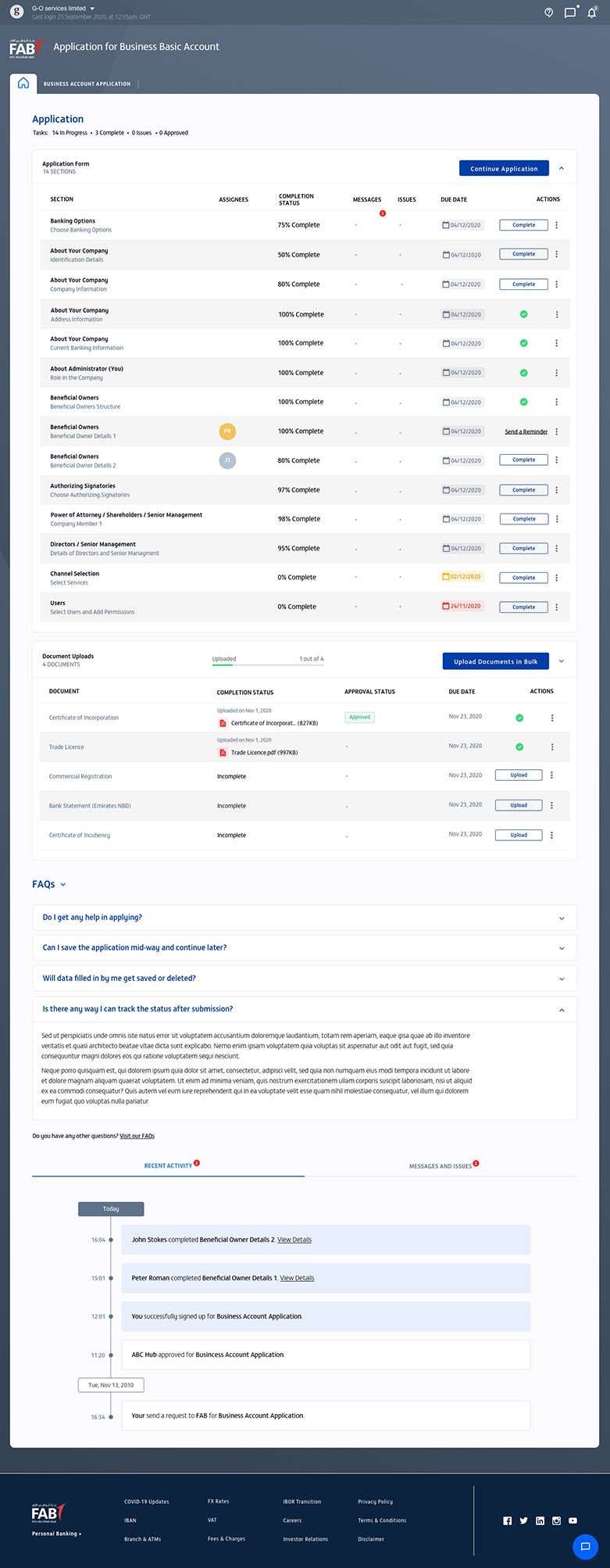

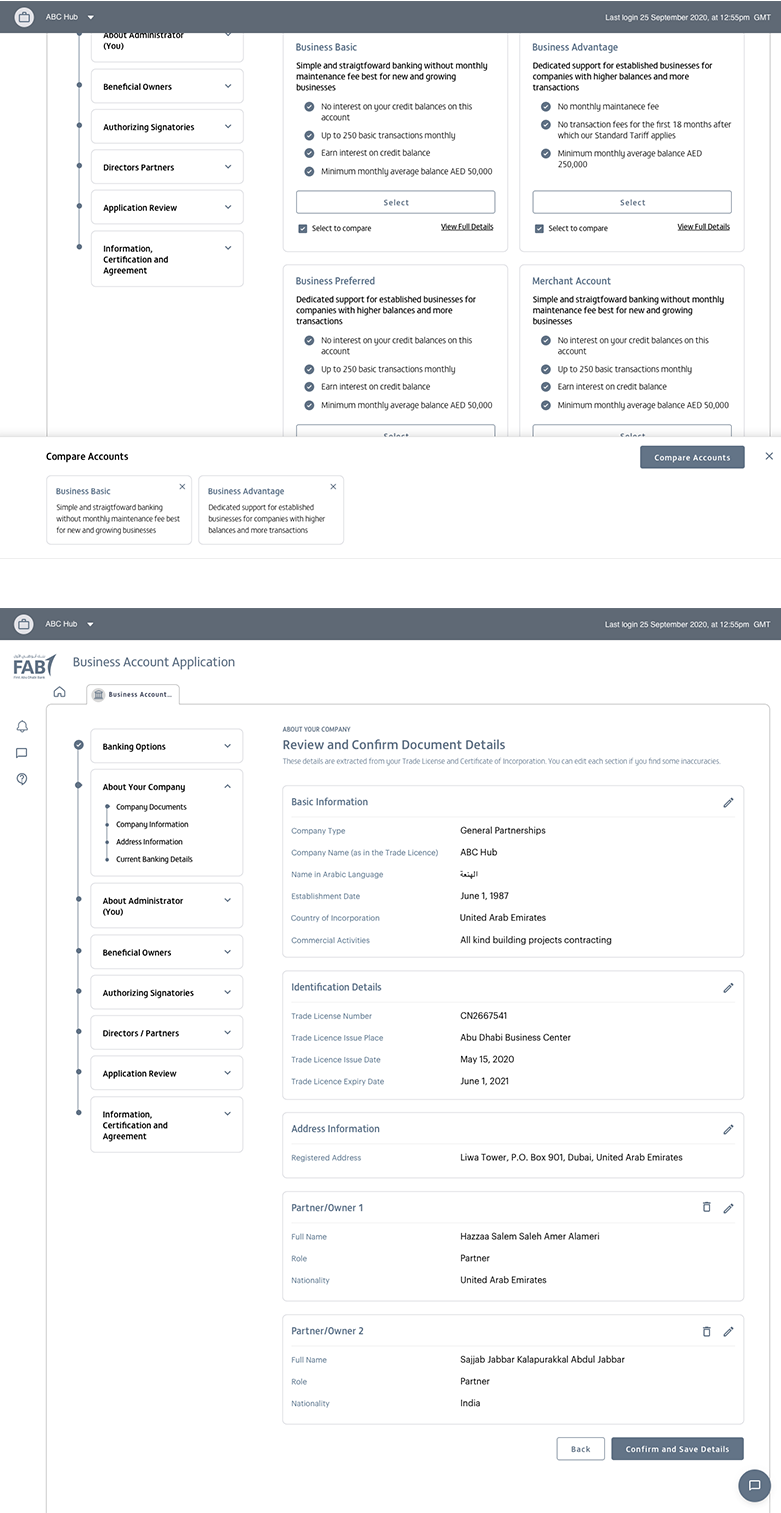

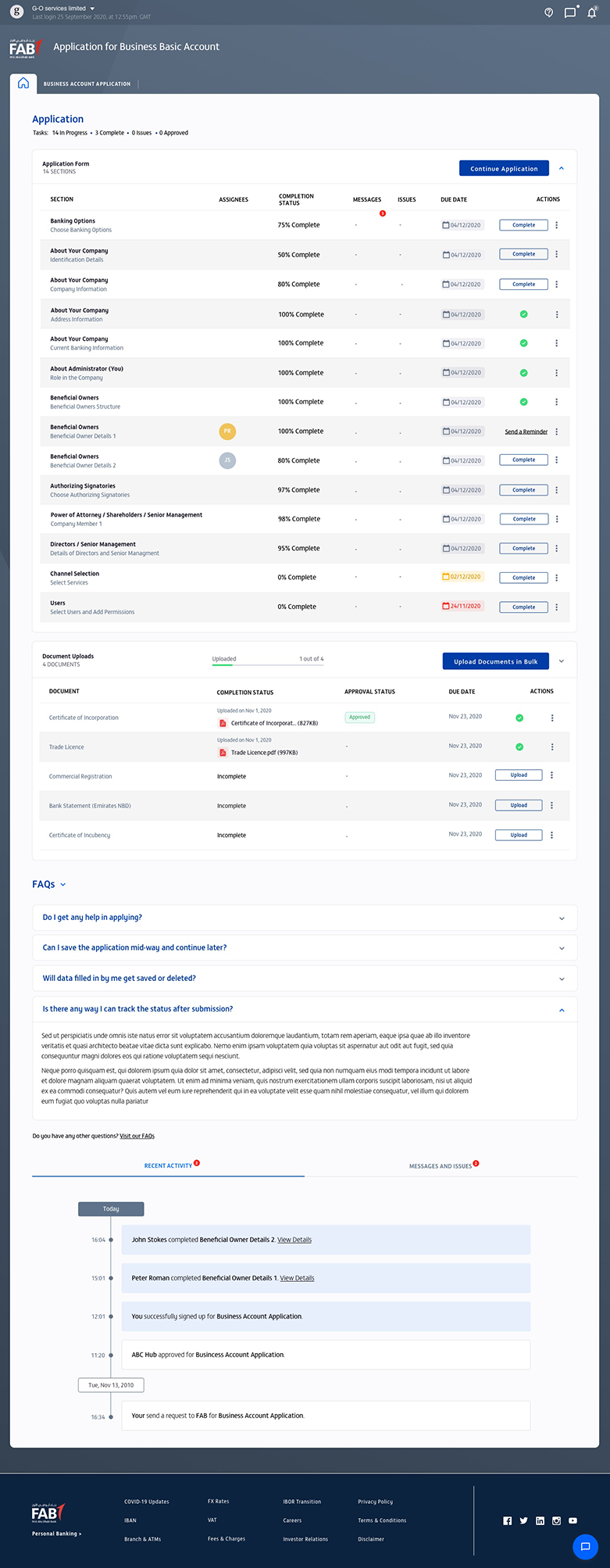

Dashboard Creation: Designed a user-friendly dashboard where users could:

-

Track outstanding tasks, such as identity verification or document submissions.

-

Monitor the progress of their application in real-time.

-

Collaboration with Cross-Functional Teams and Deloitte Agency

This project required extensive collaboration with:

-

Deloitte’s Agency Team:

-

Worked closely with Deloitte to gather requirements from stakeholders, legal, and compliance teams.

-

Collaborated on user stories and user flow creation.

-

-

Internal Banking Teams:

-

Partnered with internal teams to refine processes and address challenges posed by legacy systems.

-

Ensured all designs met strict legal and operational compliance requirements.

-

-

FinTech companies:

-

We participated in joint demo calls with third-party providers offering FinTech solutions for e-signatures, identity verification via screen sharing, and customer support to find the best solution for our needs.

-

Challenges and Solutions

Legacy System Limitations

-

Challenge: Existing technical constraints created hurdles during the discovery phase.

-

Solution: Utilised iterative sprint cycles, collaborative workshops, and close engagement with stakeholders and engineering teams to identify feasible solutions aligned with the bank's long-term goals.

Complex Requirements

Challenge:

-

The onboarding process required comprehensive verifications, document submissions, and adherence to strict regulatory standards.

Solution:

-

Created detailed user stories capturing end-to-end requirements and flows.

-

Designed a task-oriented dashboard to guide users through the onboarding process with clear, actionable steps.

-

Automated repetitive workflows, such as prepopulation of forms and real-time status updates, to reduce friction and improve efficiency.

Solutions Delivered

Unified Dashboard:

-

Centralised key actions, such as tracking application progress and managing outstanding tasks.

-

Improved transparency and reduced confusion for users navigating complex workflows.

Automation and Pre-population:

-

Created wireframes to demonstrate how integrating third-party data retrieval could enable pre-population, reducing manual errors and saving time.

Advanced Verification Workflows:

-

Leveraged FinTech solutions for seamless identity verification and document uploads.

-

Enabled real-time document validation to minimise delays.

Collaborative Features:

-

Proposed screen sharing and guided support tools for customers working alongside bank staff during application completion.

Impact

The UX/UI work carried out during the discovery phase spanned over four months, involving extensive requirement gathering, exploration, and foundational design work. Due to the complexity of legal approvals, user story refinement, and technology decisions, the project was paused before moving into agile sprint execution.

While the designs were not fully implemented during this phase, the foundational work:

-

Set a clear roadmap for future development.

-

Provided a comprehensive vision for seamless onboarding workflows.

-

Highlighted the need for multiple squads, including product owners and designers, to be allocated for building the project effectively.

-

Demonstrated my ability to lead the end-to-end design of complex workflows in regulated environments.

This case study highlights my expertise in solving intricate challenges, collaborating with cross-functional teams, and delivering impactful UX/UI solutions that align with business goals.

Help and Support Pages

As part of my role, I designed the Help and Support section for First Abu Dhabi Bank, prioritising a seamless and intuitive experience for users seeking assistance. The goal was to provide users with easy access to comprehensive resources and multiple points of contact, ensuring their needs were met efficiently and effectively.

Enhancing Login and Registration Journeys

In addition to onboarding, I contributed to redesigning the login and registration journeys for business banking:

-

Unified Login Process: Consolidated multiple systems into a single, cohesive login flow, providing users with a consistent and streamlined experience.

Navigation prototype

I also contributed to the design of the new corporate banking platform, focusing on optimising navigation and developing a multi-workspace tab system to enhance usability and efficiency. To ensure seamless implementation, I created an animated prototype that served as a detailed guide for the development team, showcasing interactions and transitions to align with the intended user experience.